Top 5 Tax Planning Tips for Manufacturers in 2024

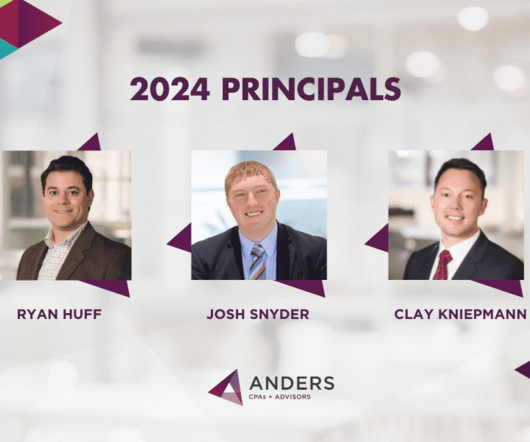

Anders CPA

OCTOBER 17, 2023

The end of the Tax Cuts and Jobs Act (TCJA) and the introduction of the Inflation Reduction Act (IRA) have ushered in a new era of tax credits and incentives for the manufacturing industry. Section 48D, otherwise known as the advanced manufacturing tax credit, was also enacted by the CHIPS Act.

Let's personalize your content